This week, the Washington Economic and Revenue Forecast Council released its June projections of economic activity and revenue collections. The Council, an independent arm of state government, provides the Administration and Legislature with these quarterly forecasts. By law, their forecasts are the basis for the Governor and Legislature’s two-year operating, capital, and transportation budgets.

Washington State’s economy continues to outperform earlier expectations. According to the forecast:

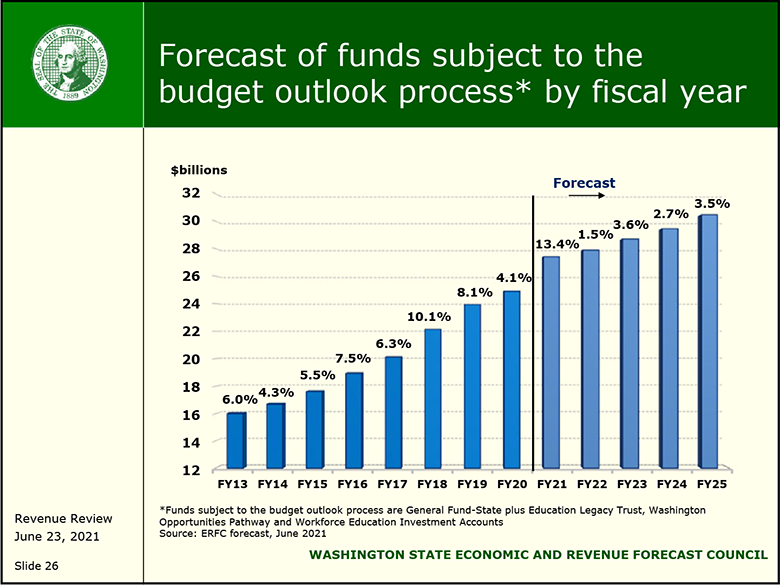

- Washington will collect $807.6 million more than forecasted for the biennium ending on June 30.

- Collections in the 2021-2023 biennium (beginning on July 1) are now forecast to be $1.239 billion more than the March forecast.

- Collections in the 2023-2025 biennium are forecast to be $1.2 billion more than forecast in March.

Strong retail sales tax and real estate excise tax collections have driven revenue growth. Note that even in fiscal year 2020, when so much of the economy was shuttered, state tax collections continued to grow.

Additionally, the Council reported on the sharp rebound in employment following the surge of layoffs mandated to protect against the spread of COVID-19. This trend, if it continues, should help relieve pressure on the Unemployment Insurance Trust Fund.

The optimistic state revenue projections will add fuel to the debate over the need for the new capital gains tax enacted in the 2021 session. Multiple parties are currently challenging the new law.

The Forecast Council will be releasing a separate forecast of transportation revenues. That may provide a hint on whether the Legislature will attempt a new transportation funding package this Fall.