During the week of September 4, federal enhanced unemployment insurance benefits ended, meaning unemployed workers are now only eligible for 26 weeks of state UI benefits. Additionally, requirements were reinstated for claimants to actively be seeking work after being paused during pandemic-related business curtailments.

As the economy has reopened, the number of people receiving unemployment benefits has steadily declined yet remained well above pre-pandemic levels. The question in early September was whether the elimination of federal benefits combined, with the reinstatement of job search requirements, would ease the shortage of available workers Retail and other sectors have been facing?”

Workers are challenged with the cost and availability of childcare, and rising COVID-19 case counts have raised safety concerns. Further, many workers changed their career paths during the pandemic.

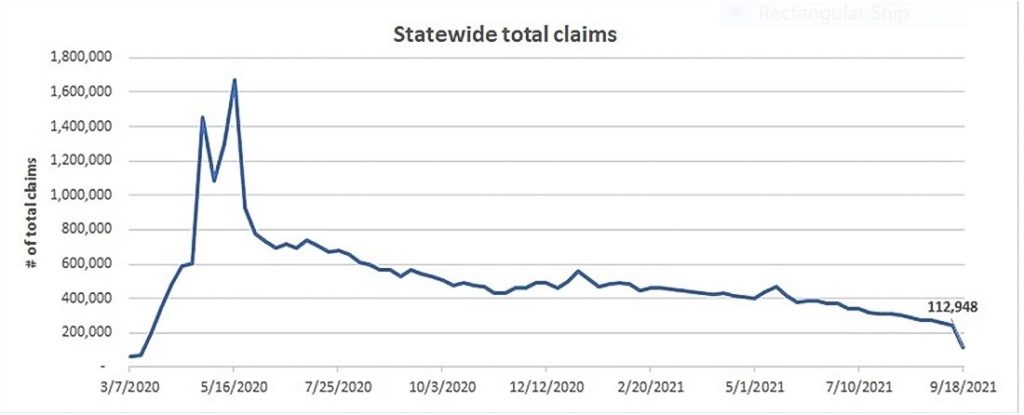

However, data released this week by Washington’s Employment Security Department (ESD) shows some remarkable changes. According to ESD, the 4-week moving average for regular initial claims is now below pre-pandemic levels. ESD also commented, “Total claims filed by Washingtonians for all unemployment benefit categories numbered 112,948, down 55.4 percent from the prior week, primarily due to the expiration of federal pandemic benefit programs the previous week.“

Click on image to see a larger view

Since the beginning of September, more than 145,000 people are no longer receiving unemployment insurance benefits. Total statewide claims are close to pre-pandemic levels. Although the data shows the declining number of people collecting benefits, it doesn’t reflect how many have returned to work or opted to leave the workforce.

Will This Trend Reduce Pressure on Washington’s Unemployment Insurance Trust Fund (UITF)?

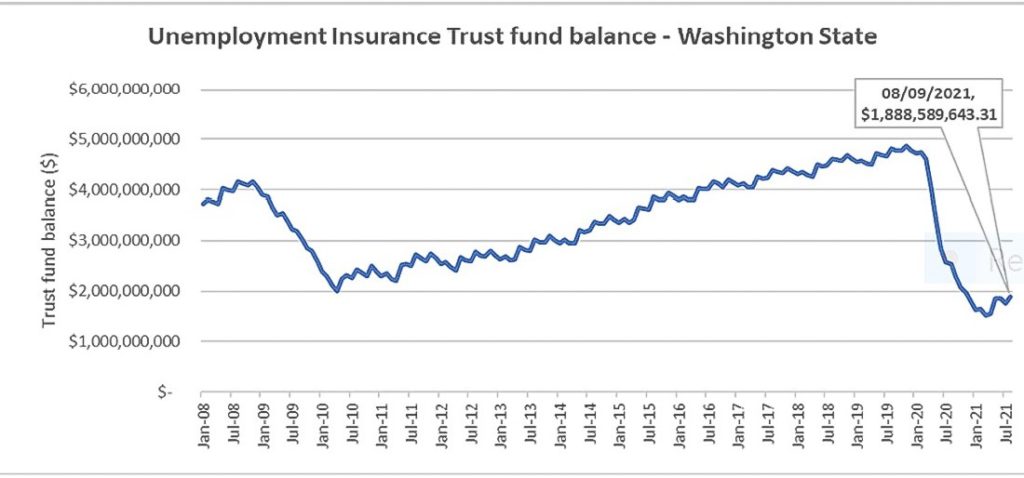

In 2020, ESD forecasted that the UITF, which pays benefits to unemployed workers, was at risk of insolvency. The Department predicted that Washington would need a short-term federal loan to continue paying UI benefits. Additionally, entering the 2021 legislative session, the declining balance in the UITF was expected to trigger large, automatic increases in employer UI taxes to regain UITF solvency and repay any federal loans.

In response, the Legislature allocated $500 million of Federal COVID relief funds to “buy down” employer experience rate tax hikes and provided relief from other UI taxes. Those actions reduced the increase in UI taxes but did not relieve employers of all COVID-related unemployment-related costs.

With the economy reopening, and people returning to work, the balance in the UITF has turned upward. Indeed, the balance in the UITF in August indicates that Washington will not need to take a federal loan. This month’s sharp decline in the number of claims suggests that the balance in the UITF should continue to improve at an even more rapid pace. If so, this may create opportunities to further relieve employers of COVID-related unemployment insurance costs in 2022.