Published by Washington Research Council

By: Emily Makings

January 28, 2025

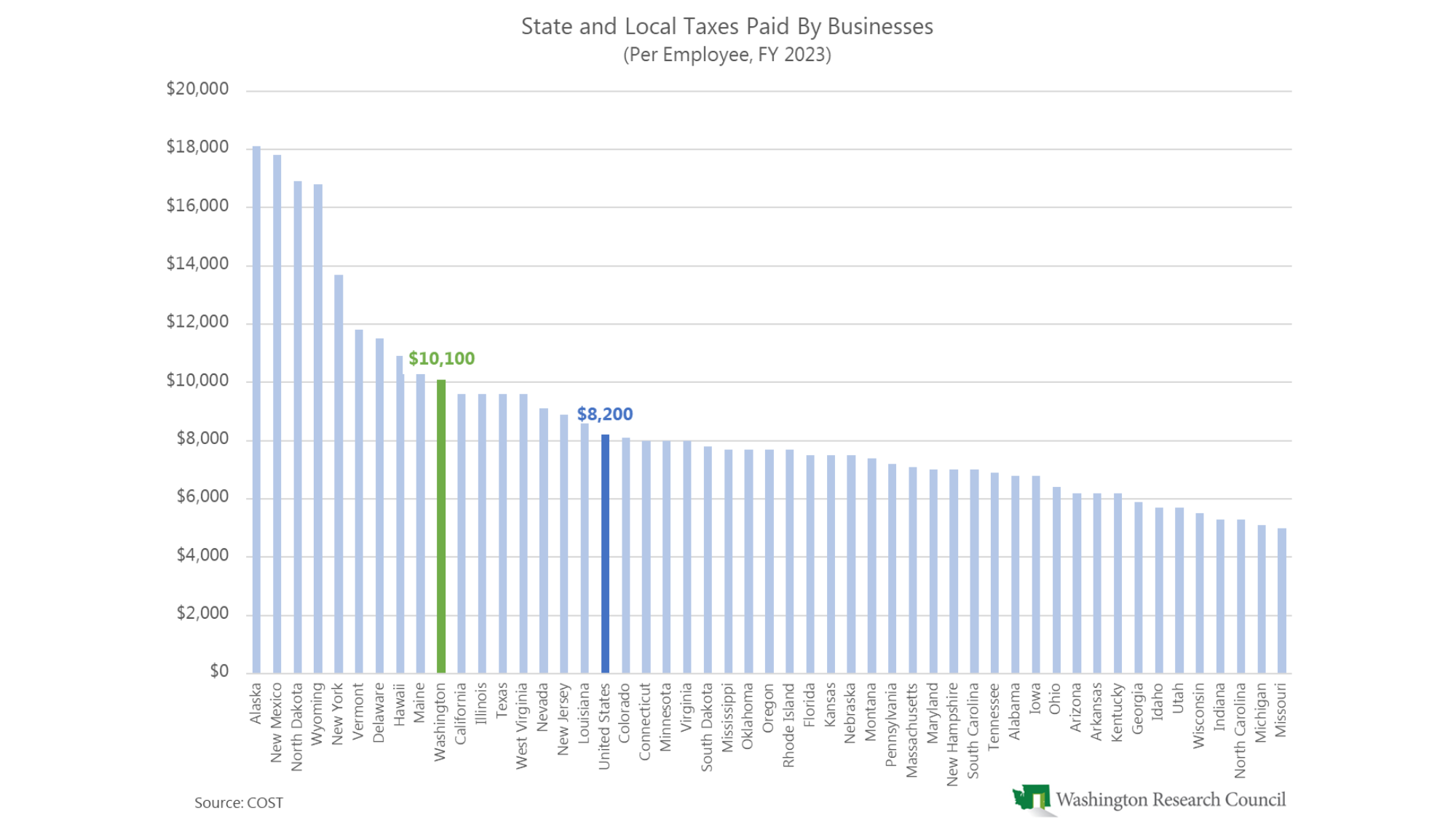

According to the Council on State Taxation (COST), Washington businesses paid $10,100 in state and local taxes per employee in fiscal year 2023, the 10th highest amount among the states. (Note that the states with the four highest per-employee taxes paid by business are Alaska, New Mexico, North Dakota, and Wyoming—all resource extraction states that rely on severance taxes. Excluding them, Washington would rank 6th.)

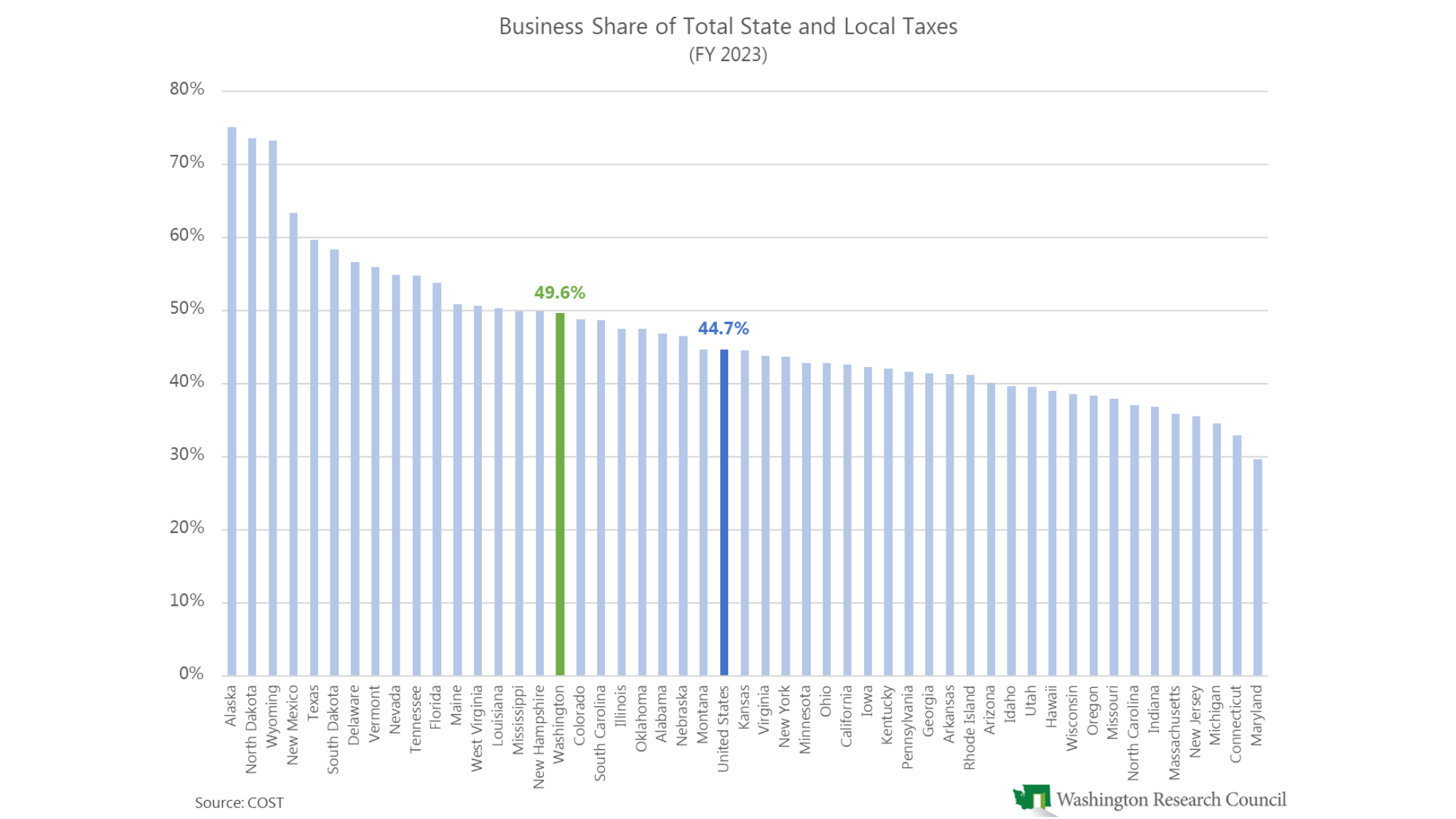

COST also finds that businesses in Washington pay 49.6% of all state and local taxes (the 17th highest in the nation).

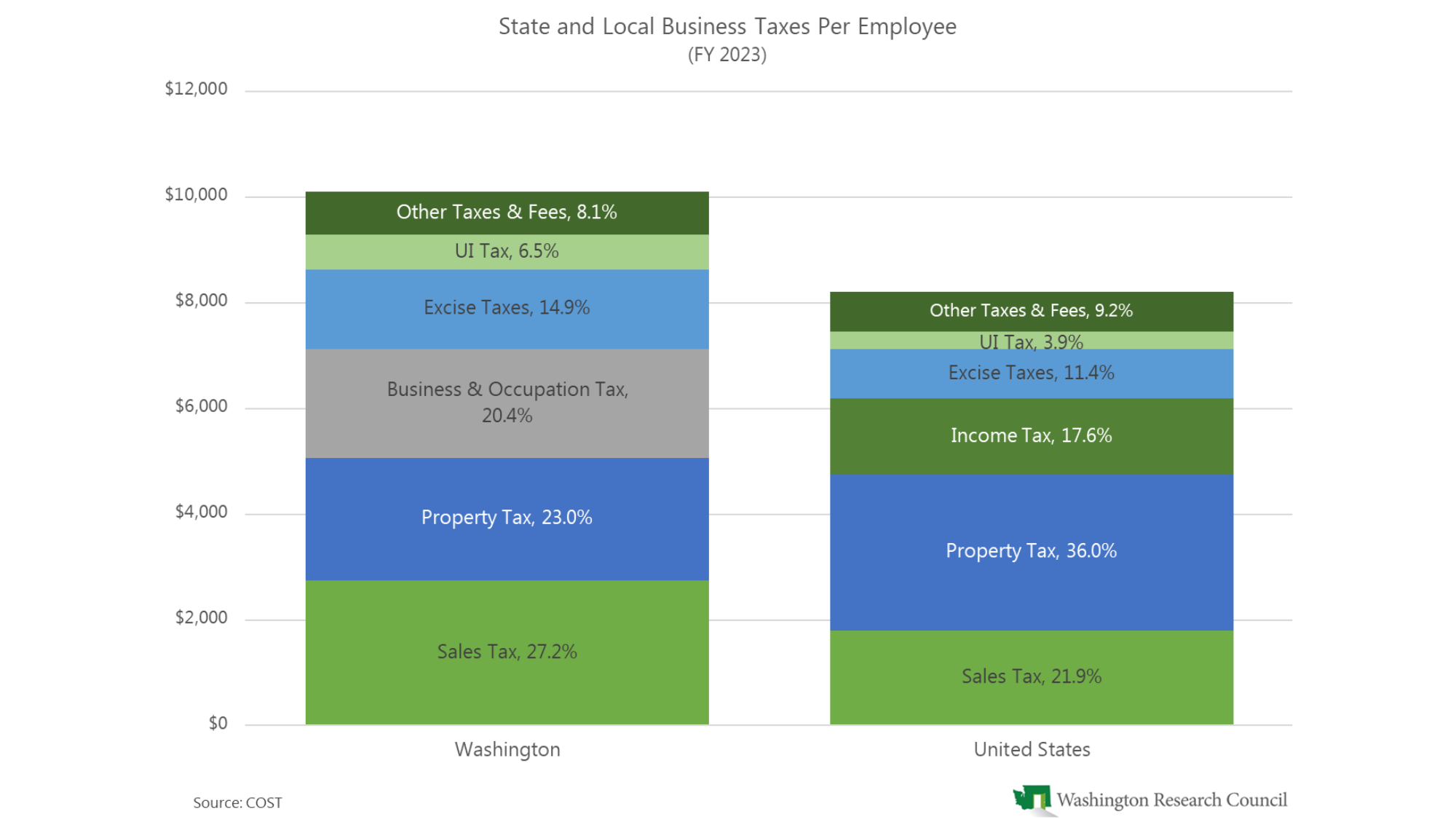

The FY 2023 numbers are very similar to those of FY 2022. We wrote in more depth about COST’s FY 2022 business tax burden study in this report a few months ago. As we noted then, Washington businesses do not only pay the business and occupation (B&O) tax. They also pay sales, property, and other taxes.

Despite the high tax burden Washington businesses face, former Gov. Inslee proposed increasing the B&O tax, and revenue options circulated by the Senate Democratic Caucus include increases to the B&O tax and a payroll tax on employers.