According to the latest MetLife & U.S. Chamber of Commerce Small Business Index, small businesses’ concerns about inflation remain at record levels, and their view of the economy has weakened slightly. Despite this, the majority of small business owners continue to feel optimistic about their business health and cash flow.

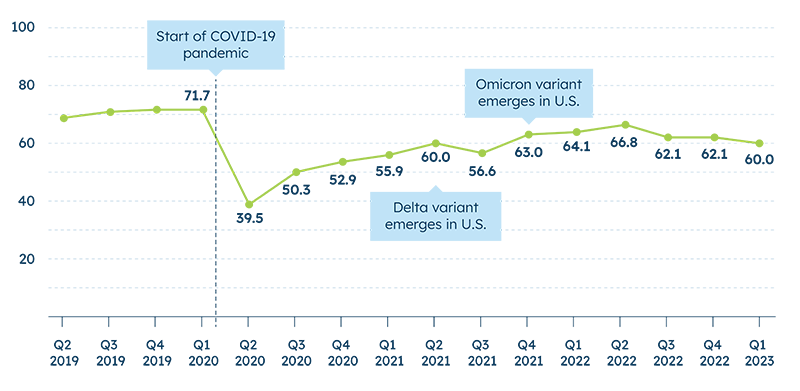

Small business owners seem to be in a wait-and-see mode, with day-to-day operations and future expectations largely unchanged compared to the previous two quarters. The Index score for this quarter is 60.0, a slight drop from the previous quarter’s score of 62.1, mainly due to a more pessimistic view of the national economy. The Index score is now closer to early 2021 levels and slightly lower than its post-pandemic peak of 66.8 in Q2 2022.

Inflation remains the top concern for 54% of small business owners, marking the fifth consecutive quarter it has topped the list of challenges. Other issues such as revenue, supply chain disruptions, and rising interest rates are considered secondary concerns.

Long-term perceptions of access to capital have significantly declined, with 49% of small business owners now reporting their current access to capital or loans is good, compared to 54% in Q2 2022 and 67% in Q2 2017.

Although most small businesses see the value in offering health insurance coverage, they often find selecting the right options to be a time-consuming task. A significant majority (89%) of small businesses believe offering employee healthcare is the right thing to do, and 85% agree it helps attract and retain employees. However, 65% find navigating healthcare options for their business to be a burdensome process.

In summary, the MetLife & U.S. Chamber of Commerce Small Business Index has slightly decreased to 60.

Read the U.S. Chamber’s report