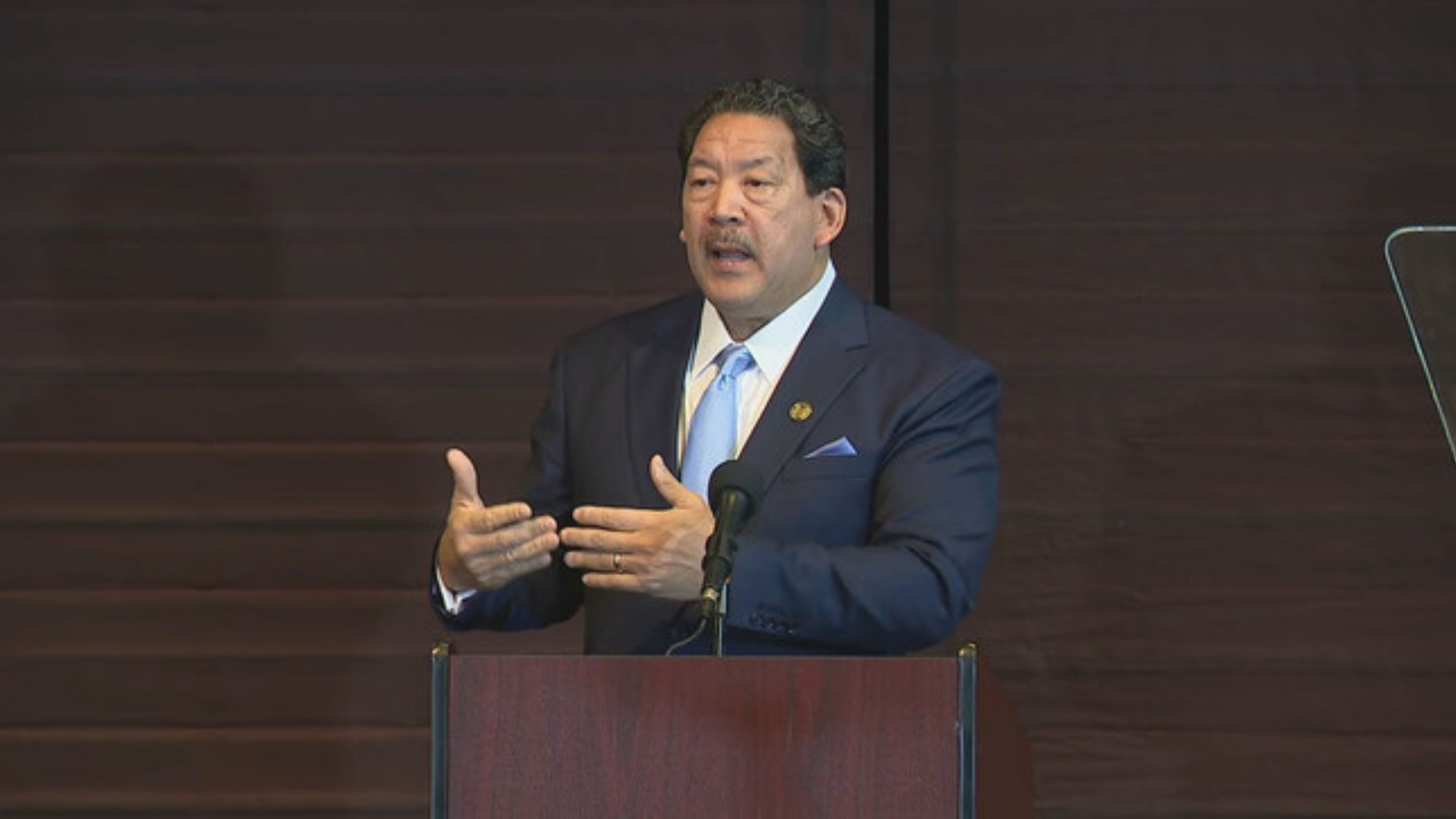

Seattle is facing a projected $240 million shortfall in tax revenue for the 2025–2026 biennium, prompting Mayor Bruce Harrell to direct city departments to reduce or eliminate spending on “travel, nonessential equipment upgrades, and new consultant contracts.” The Mayor indicated that additional project cuts will be considered on a “case-by-case basis”, and the city’s existing hiring freeze will remain in effect.

Mayor Harrell also suggested that he could include new progressive taxes in his 2026 budget plan. The Council considered a local capital gains tax while deliberating on the 2025 budget but ultimately decided it needed additional study. A higher JumpStart tax, the payroll tax on large companies, could also surface in the Mayor’s budget proposal.

A number of factors are driving the projected revenue shortfall. After years of out-performing projections, the JumpStart tax is expected to perform below the forecasts used to develop the 2025 and 2026 budgets. Given the current glut of commercial office space in the city, construction-based tax receipts are trending downward, while sales tax revenue from personal and business spending is flat after years of growth.

Broader economic concerns are compounding the city’s financial outlook. Potential federal tariffs and a possible decline in international tourism, critical to Seattle’s trade-dependent economy, are raising alarms. With the 2026 World Cup on the horizon, tourism-related worries may intensify. Additionally, ongoing reductions in federal grants and spending are contributing to the city’s budget challenges.

These factors, combined with uncertainty about the national and local economies, led the Seattle Office of Economic and Revenue Forecasts to take an unusual step – it urged City government to use the most pessimistic of the three budget projections it developed.