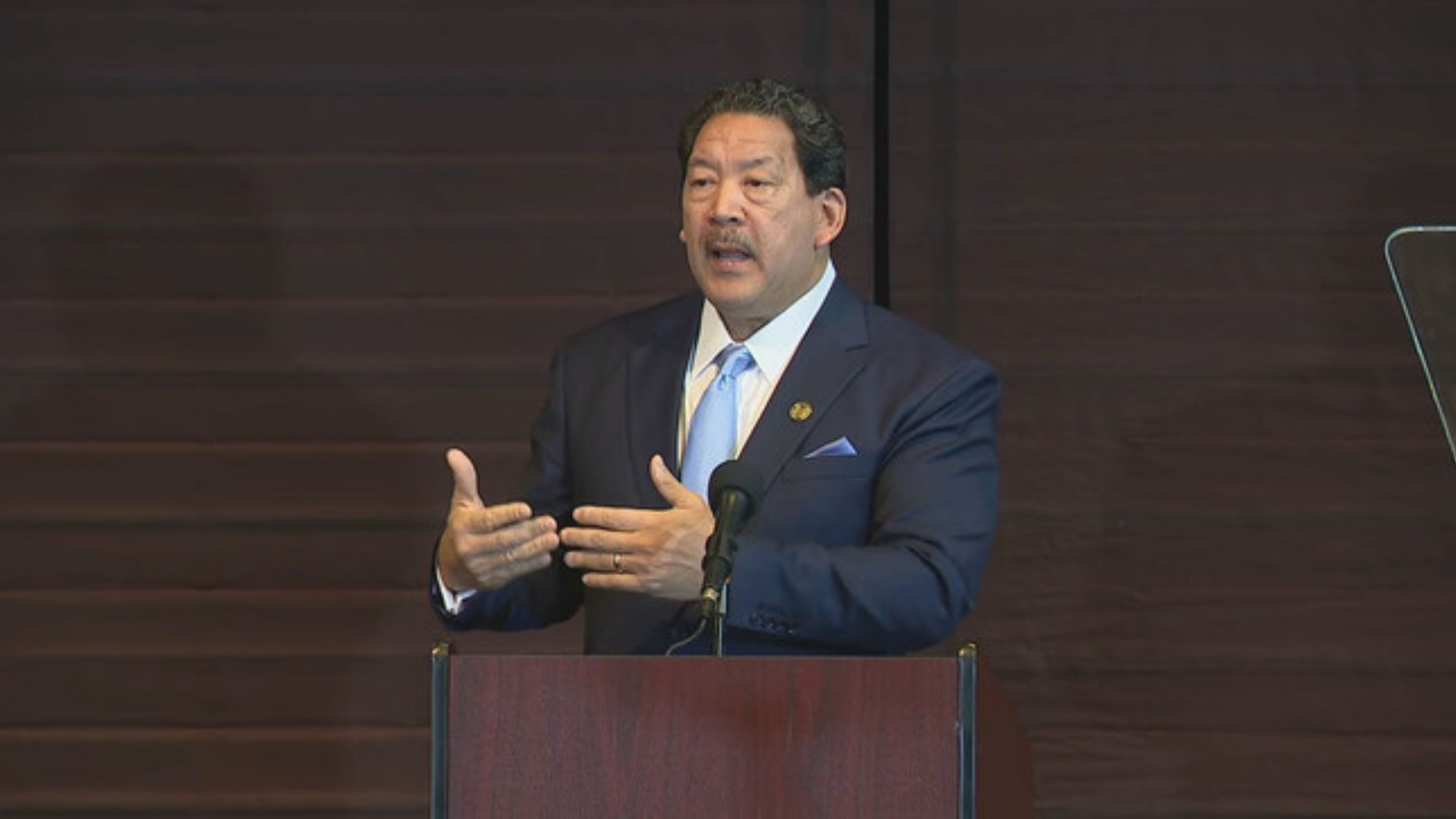

Mayor Bruce Harrell and Councilmember Alexis Mercedes Rinck released a plan to shift some of the city’s business and occupancy (“B&O”) tax from small businesses to the businesses in the city with the highest gross revenues.

Facing a $240 million budget shortfall over the next two years, this tax plan would also generate additional tax revenue for the city. The proposal would exempt businesses with less than $2 million in gross revenue from paying any city B&O tax. According to the Mayor’s office, this exemption would cover 76% of businesses in Seattle. Another 14% of businesses would pay less in taxes.

The remaining 10% of businesses, those with the highest gross revenues, would pay B&O taxes that are 50% higher than what they currently pay. For large grossing retailers, the tax rate would jump from $.22 per $100 in revenue to $.34.

The Seattle Metropolitan Chamber of Commerce has already announced its opposition to the tax proposal. Katie Wilson, the progressive challenger to Mayor Harrell, supports the proposal but also called it cynical. “Harrell’s in a corner and he’s doing what he has to do and he’s trying to make it look like he’s taking the lead,” Wilson said. “He’s not.”