The Economic and Revenue Forecast Council (ERFC) recently released its monthly report on general fund revenue collections, covering payments received between June 11 and July 10. The report encompasses various taxes, including sales tax, use tax, business and occupation tax, public utility tax, tobacco products tax, and penalties and interest, collectively referred to as Revenue Act receipts. Additionally, it includes payments received between June 1 and June 30 for liquor taxes, cigarette tax, property tax, real estate excise tax, unclaimed property, and other sources.

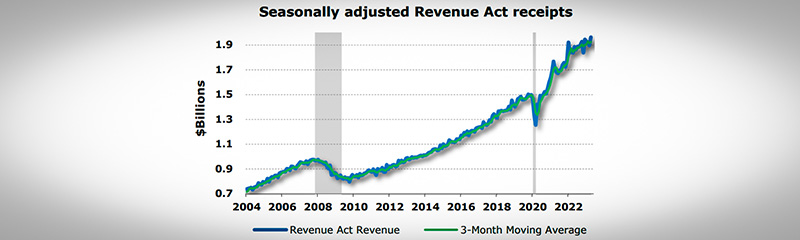

The total revenue collected for the month amounted to $2,444.7 million, surpassing expectations by $101.1 million (4.3%) based on the forecast adopted on June 22. Revenue Act taxes, particularly sales, use, utility, and business and occupation taxes, exceeded the forecast by $102.1 million (5.7%). These taxes generally indicate economic activity in May, with retail sales tax collections increasing by 6.9% year over year and B&O tax collections up by 11.9%.

On the other hand, Non-Revenue Act taxes fell slightly short of the forecast by $224 thousand (0.04%). However, real estate excise tax (REET) collections performed remarkably well, exceeding expectations by $10.3 million (11.7%). Notably, the value of transactions subject to REET has experienced a significant 50% decline since the latter half of 2021. In addition, court fees, fines, and forfeiture payments into the general fund totaled $806 thousand (18.1%) less than the forecasted amount.

In terms of inflation, there has been a downward trend since mid-summer 2022. For seven consecutive months, year-over-year CPI inflation had outpaced the increase in GFS (General Fund State) revenues. However, revenue growth surpassed CPI inflation in June by 1.7 percentage points.

Overall, the report indicates positive growth in Revenue Act taxes, particularly retail sales, and B&O taxes, while Non-Revenue Act taxes showed minor deviations from expectations. Additionally, real estate excise tax collections performed remarkably well despite a previous decline in transaction values. Furthermore, inflation trends have shown promising developments, with revenue growth now outpacing CPI inflation.

The July collections report is available here.

Read the original article from the Washington Research Council